Not long ago, most beauty purchases had to be made in a department store. Counters were segregated by brand and shoppers had to navigate puffs of perfume as they wandered from counter to counter. Today, retailers like Sephora and Ulta are bent on changing that experience. And online sales for beauty are strong, despite the tactile nature of the product. Here’s how they did it.

In-store experiences speak to millennials and gen Z

One of the biggest differences in the beauty sector versus other retail segments is the draw of experience. While most retailers strive to create an “experience” through marketing, social media and weaving together online and in-store visits, beauty has a particular edge.

“Nobody goes shopping because they want more expensive colored powder in their bedroom,” Jason Goldberg, senior vice president of content and commerce at SapientRazorfish told RetailDive earlier this month. “They’re shopping for cosmetics because they want to look beautiful at their spring dance or on their date or whatever the case may be. They’re literally shopping for an experience, so delivering an experience during the shopping occasion is super important, [whereas] you don’t necessarily want a real high-tech immersive shopping experience to get more toilet paper.”

When it comes to in-store experiences, Sephora is leading the way. First, the retailer’s ability to gather all the best brands under one roof has disrupted the department store model of yesterday. In 2015, Sephora opened an innovation lab in a San Francisco warehouse to test new technologies that combine in-store and online experiences. Today, Sephora stores have a suite of technology to help customers experience new products. Laura Holson of the New York Times writes, “Want to try 50 shades of lipstick without getting chapped lips? There is a mobile app using augmented reality for that. Customers can scan their faces to get their Color IQ, a reference number used to find products that match their skin tones, or sit at digital workstations to take classes in contouring cheekbones. Sephora even has its own version of Smell-O-Vision, a touch screen with a fan that lets visitors smell the scents — floral, earthy — that characterize most fragrances.”

Cracking online sales with Birchbox, Glossier and Amazon

One of the reasons the beauty sector is doing well is due to the experiential nature of the business. Couple that with social media and YouTube beauty experts and you have a booming market driven mostly by young female consumers. “That’s part of the reason newcomers like Birchbox and Glossier have managed to successfully break into the market, with Birchbox reaching profitability in April, Glossier making plans to expand overseas and rumors of a Birchbox acquisition beginning in early August,” writes RetailDive.

While Sephora and Ulta coax shoppers into physical stores, online beauty is also booming as well. Glossier is an online beauty site that uses videos and influencer reviews to break down barriers to buying before trying. Birchbox is a subscription box that delivers monthly beauty samples. Subscribers can buy full-sized versions of items they love and keep trying high end brands at a lower cost.

Of course, Amazon is also participating in the beauty sector. Currently, Amazon sees most sales from buyers who want to “restock” a beauty item and have already tried it and bought it elsewhere. According to Digital Commerce 360, Amazon was responsible for more than 21% of all online beauty sales in 2016. Industry experts are keeping an eye out for Amazon’s next big move and some believe it could be in the beauty sector. After successfully shaking up groceries by acquiring Whole Foods, who knows what’s next for the biggest fish in e-commerce?

Innovation and technology are key

While the beauty sector does invite experiential marketing that’s well suited to today’s technology, the winners in this category invested in innovation. Rather than pining for a simpler time that is long passed, retailers like Sephora and Ulta created in-store experiences that harness technology and compete with the online space.

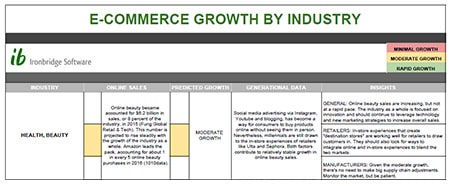

True, other categories may struggle to tap into experiential marketing in the same way, but innovation can’t be ignored. We’ve written here before that those who invest in technology and delivering a new experience come out ahead in these shaky times (take a look at our e-commerce matrix to see what Domino’s Pizza is up to). The beauty sector seems to be no different and is especially flourishing when it leverages new technologies.

If you like what you read here or would like to share your own take on a topic, please leave us a comment below!

Do you need a partner to help you innovate? Ironbridge can help. We offer clients a fresh look at their business using big data and visual analytics. Solve your toughest business challenges by requesting a demo today.

Written by Kim Kelly Consulting.